Image: Trim

Image: Trim

You’re probably spending more than you think on monthly subscription services—music streaming, cloud storage, video libraries, software packages… the list goes on and on. Add them all up and you might be talking about a substantial chunk of money going out on a regular basis. Here’s how to start cutting back.

1) Switch to free options

Screenshot: Gizmodo

Screenshot: Gizmodo

Admittedly, there’s no (legal) way to get everything that you currently pay for free, but you can find some no-cost options for a lot of the digital goods you’re buying.

Take cloud storage, for instance. You don’t get much space free of charge from each provider, but if you can spread your files across Google’s free 15GB, Apple’s free 5GB, Dropbox’s free 2GB, Amazon’s free 5GB, OneDrive’s free 5GB and Box’s free 10GB, you’ve got 42GB of room there to play around with.

And don’t forget Google Photos will take all your photos and videos without you having to pay a penny, if you’ll allow them to be resized down to 16MP and 1080p respectively.

Software subscriptions are another area you can save some money. GIMP isn’t quite Photoshop, but it’ll do for a lot of people and Pixelmator for Mac is also great, but will cost you a one time fee of $40—still less than subscribing to Adobe’s Creative Cloud for a few months. Meanwhile you can safely ditch Microsoft Office 365 for Google Docs, Sheets, and Slides if you never use the advanced features of the suite.

Unless you’re happy breaking the law, it’s tricky to get the latest Hollywood blockbusters and hit albums for free, but you can find plenty of alternative music and older movies on the web without having to pay for them. If you absolutely must have services like Apple Music, look for any bundles that might be available. And don’t forget Kanopy, the totally free streaming movie service you might have access to through your public library.

2) Consolidate your accounts

Screenshot: Gizmodo

Screenshot: Gizmodo

It’s time to go through your bank statements and work out exactly what you’re subscribing too—are there any accounts that could be combined or consolidated? If you’ve signed up for YouTube Music, do you really need to have Spotify too?

When it comes to paying for cloud storage, you don’t really need to give both Dropbox and Google $10 a month if you’re only storing 250GB or so in each cloud locker—move files from one to the other (you might even find some duplicates), and then stop paying for the one you like less.

Obviously, this requires a little bit of time, effort, and diligence on your part, but it could save you some serious cash if you’re still paying for services you don’t really need. You might even find you can afford a new subscription with the savings.

It’s worth doing this sort of audit on a regular basis—maybe every six months or so—otherwise you risk paying out when you don’t really need to. If you’ve never done it, you might surprise yourself at how much you’ve actually signed up for.

3) Spot the savings

Screenshot: Clarity Money

Screenshot: Clarity Money

As usual, there are apps around to help too: Clarity Money (Android, iOS) is a good example. Give it access to your bank accounts, and it highlights all the regular outgoing monthly payments it can find, labels them with the relevant digital service, and gives you a one-tap option for canceling them.

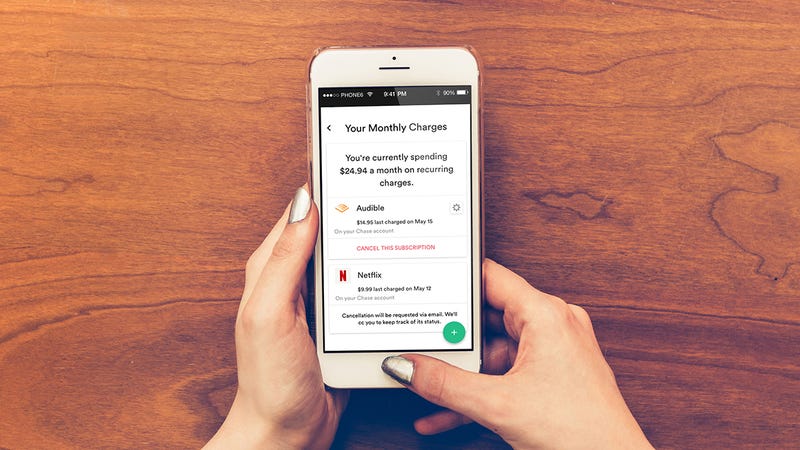

Trim works along similar lines but functions through the web and either SMS or Facebook Messenger. Again, monthly, recurring debits are highlighted after you’ve connected your bank accounts, with the amount and the service listed in each case—you can then cancel any that you no longer need or have completely forgotten about

Truebill (Android, iOS) is even more comprehensive. Not only does it spot, identify, and help you remove recurring subscriptions, it also throws in all sorts of other smart financial tools—everything from budget tracking to alerting you to special offers on utilities and services so you’re not paying over the odds.

You don’t necessarily need an app to do this job—a spreadsheet or good old pen and paper would do as well—but it’s more convenient to have everything set up on your phone and only a tap away.

There is also an element of trust here: These apps will have access to a lot of financial information about you. Clarity Money says it will market offers to you, but won’t let third-parties do the same, and won’t share information about your creditworthiness—though . Trim says it may share anonymized, aggregated data with business partners who want to advertise to specific demographics.

Truebill says your information may be shared with third-parties but only with your permission. As is the norm, these policies are vague and designed to leave a lot of flexibility for the apps and services to work in—read through the policies and don’t sign up if you have any doubts. And as usual, we’d recommend disconnecting from these apps if you’re no longer using them.

4) Share your accounts

Screenshot: Gizmodo

Screenshot: Gizmodo

Do you really need a whole subscription or account to yourself, or can you share it with others? An obvious place to start here is with the family plans offered by the likes of Spotify and Apple Music—they let you get more people on the service for less (provided you all live at the same address).

Elsewhere the approach to account sharing differs all across the board. Netflix is more or less okay with it, and even lets you set up multiple user profiles on one account subscription (though your plan will limit you to a certain number of simultaneous streams). Hulu lets you sign in on as many devices as you want, but you can only run one stream at a time.

Most accounts can be shared fairly easily, though be careful about who you share your login credentials with and practice good password security along the way. Make sure your account isn’t being left logged in on a device other people can get to.

Maybe you could go halves with someone on a digital news or magazine subscription too. Ask around your social circle and see who might be subscribed to an account you can benefit from—or who might be able to make use of something you pay for.

A Creative Cloud subscription lets you install Adobe programs on two computers with one account, for example, though only one computer can be actively using the apps at any one time. An Office 365 subscription, meanwhile, entitles you to be signed into up to five devices at once, so there’s usually some flexibility.

5) Do without

Screenshot: Gizmodo

Screenshot: Gizmodo

We briefly mentioned canceling your accounts higher up in this article, and if you want to save as much money as possible on digital services then it might be time to ditch one or more of them—if you can.

Thankfully the process is usually very simple. Why not take a break from Netflix for a few months, if you’ve watched pretty much everything there is on there already? Or press pause on a Spotify subscription if you know you won’t have time for music for a while? You can easily get back to your account again in the future—just re-add yourself as and when necessary.

Take the time to weigh up whether you’re still making full use of the services you’re paying for. Take security cameras, for instance—most come with an optional monthly subscription package but offer plenty of features for free too. So unless you need weeks of archive recordings that might be one saving you can make.

There are still some areas of life where it’s possible to live without digital services: One option would be to cancel everything and then add your subscriptions back one by one if you find you really can’t do without them.

When it comes to the one-off purchases—music downloads, movie rentals, and so on—all the old-fashioned belt-tightening methods can be put into practice. Keep tabs on what you’re spending, set yourself a budget, and look for cheaper alternatives (both Google and Apple regularly run deals on digital movie rentals).

Do you have any tips for cutting back how much you spend on digital subscriptions? Let us know below!

Share This Story